US consumers are downloading fewer mobile games this year than in the past thanks to a combination of factors including the lifting of COVID-related restrictions and rapidly rising inflation.

Of the 14 mobile game genres tracked by app analytics firm Sensor Tower, only one saw an increase in downloads in the first half of 2022, while most others experienced sharp declines…

Sensor Tower measured downloads and revenue, and both numbers are down in the first half of this year compared to the same period in 2021.

In the first half of 2022, in most US mobile game genres, player spending and downloads declined, according to Sensor Tower Game Intelligence, as the market fell 9.6% year-over-year to $11.4 billion.

Download mobile games

The Action genre was the only one to see an annual increase in downloads for both iOS and Android.

The action genre saw the fastest growth in downloads in the first half compared to the same period in 2021, up 5.4 percent year on year to 54.7 million.

The most popular Action sub-genre for downloads was Action Sandbox, which saw a 2.3% year-on-year increase in downloads to 15.7 million installs.

The #1 action game by number of downloads was miHoYo’s Genshin Impact with 2.3 million downloads, followed by Rocket Go Global’s Galaxy Attack: Space Shooter at number 2 and Galaxy Attack: Alien Shooter, also by Abigames, at number 3. .

Sports stayed the same, downloads stayed the same, while Simulation, Puzzle, and Shooter saw modest declines. From there, things get worse.

Income

The picture is even bleaker when you look at revenue.

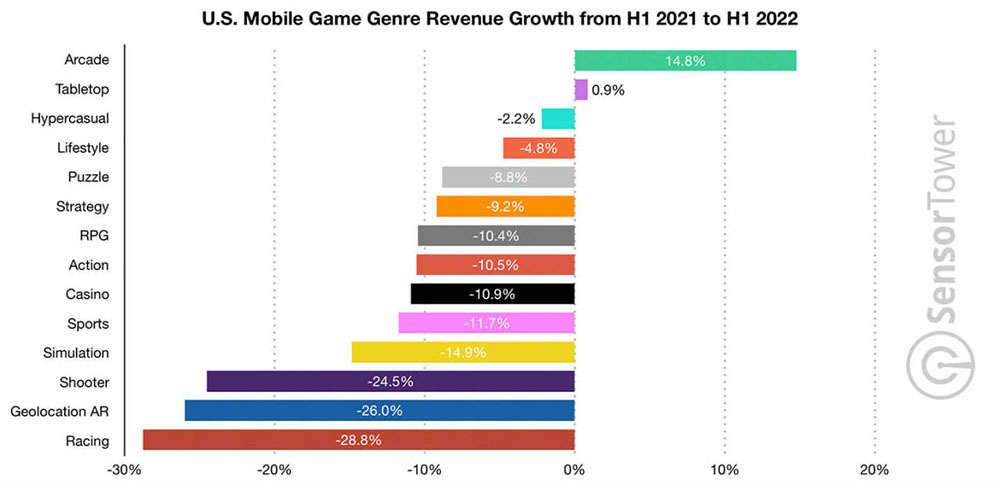

Arcade was the fastest growing genre, with players spending 14.8% more on it than last year to around $176 million. The largest slot sub-genre by player spending was Idler, which brought in about $88 million, up 35.3% from last year. The No. 1 arcade game by player spending was Gigantic’s Clawee, which grossed $16.5 million in the US in the first half of the year. It was followed by Gold & Goblins by AppQuantum Publishing at number 2 and Idle Mafia by Century Games at number 3.

The second fastest growing genre by revenue in H1 2022 was board games, which grew by approximately 1% year-on-year to approach $388.8 million. All other mobile game genres saw a decline in total player spend in the first half of the year, with the sharpest decline seen in racing, down 28.8%.

Puzzle was the largest spending category in H1 2022, grossing $2.3 billion, down 8.8% from the previous year. It was followed by Casino at number 2, which brought in $2.2 billion, and Strategy, which accumulated $2 billion.

Some of the reasons for the decline are obvious. With the country reopening after the COVID lockdown, there are far more entertainment options available than there were when people were stuck at home and many establishments were closed.

Inflation was also hit hard and consumers saw their purchasing power plummet. The economic uncertainty associated with this also means that people are in control of their spending, even if they are currently doing well.

But Sensor Tower says Apple’s App Tracking Transparency is hurting its revenue too. Without the consent of iPhone owners to be tracked, free apps can no longer sell personalized ad spaces, which means ad networks pay them significantly less to show generic ads.

Photo: Screen Post/Unsplash

similar

The post Mobile game downloads and revenues have fallen due to multiple factors appeared first on Gamingsym.