There is panic in the cryptocurrency market. Shunned by investors, Bitcoin continues to lose value. Several firms in the ecosystem seem close to default.

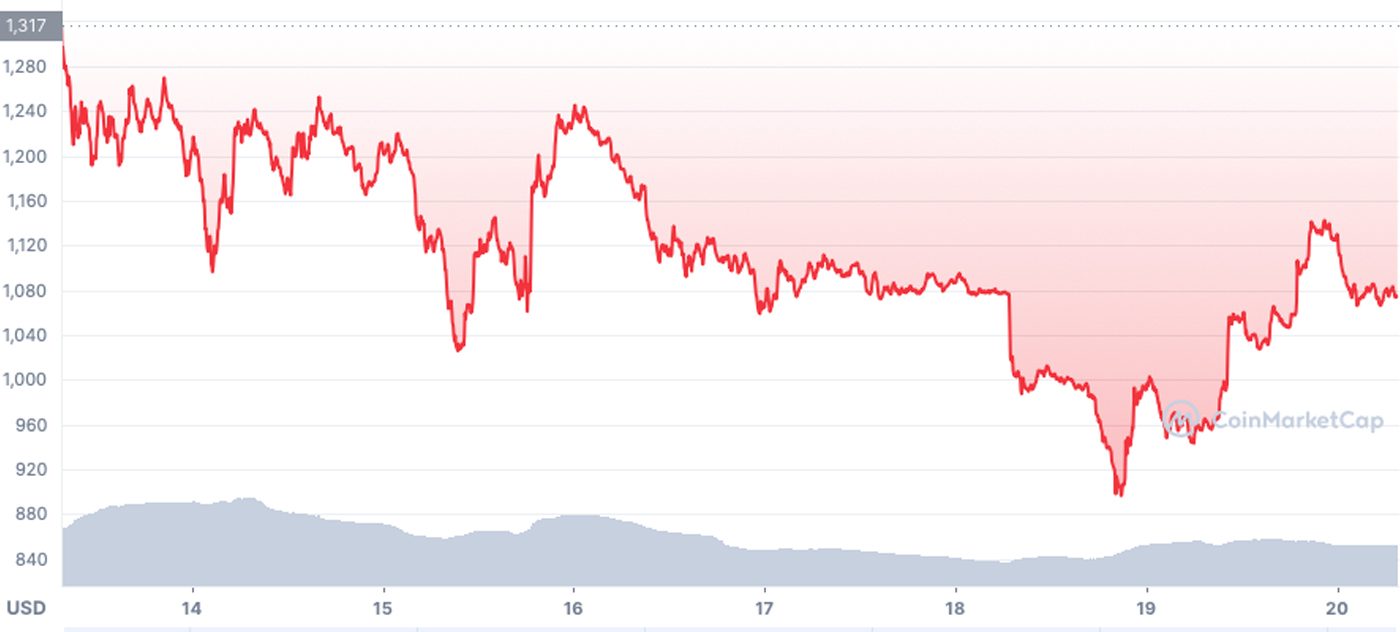

The Bitcoin price suddenly fell below $20,000. Saturday, June 18, the queen of cryptocurrencies even briefly collapsed below $18,000, unheard of for 18 months. Bitcoin is a long way from its November 2021 high above $68,000 and its 2022 high of $48,234.

One detail in particular caused panic among investors: the price revisited a price zone located below the highest level of the previous bull cycle, which ended at the end of 2017. That year, Bitcoin for the first time flirted with the $20,000 threshold. By sliding below this threshold, the cryptocurrency realizes a historic first. Indeed, the price had never fallen below the record set during the previous cycle after a new upward phase.

Cryptocurrency, inflation and traditional finance

Mirroring King Bitcoin, the entire cryptocurrency market has entered a bearish phase. Ether, whose protocol update is expected in the coming months, fell below $900. All altcoins went into the red this weekend.

The fall in crypto-assets accompanies that of traditional finance. Following the monetary tightening of the central banks, the stock market indices appear at half mast. The S&P 500 has also lost more than 20% since the start of the year. Faced with inflation and the risk of recession, investors are massively turning away from the riskiest assets, such as cryptocurrencies. Non-fungible tokens (NFTs) are also affected.

For Alkesh Shah, head of digital asset strategy at Bank of America, “Investors continue to position themselves on the defensive”. Questioned by the Swiss media, Cyrus Fazel, managing director of the crypto platform Swissborg, agrees. He points out that there is “less money on the market”, which pushes investors towards the least risky stocks.

“What we are seeing is more liquidations driving prices down, which is triggering more liquidations and negative sentiment – some rinsing is still needed, but that will run out at some point”explains Noelle Acheson, market analyst for the company Genesis, to Bloomberg.

As can be seen on the Coinglass website, 85,731 traders have been liquidated in the last 24 hours, i.e. over $300 million gone up in smoke. Bearish movements like this are not uncommon in the history of Bitcoin. Since its creation, cryptocurrency has often lost up to 80% of its value, destroying newly built fortunes, before starting to rise again a few years later.

Read also: In its early days, bitcoin was neither egalitarian nor decentralized…and that’s a problem

The first victims of the cryptocurrency crash

The sharp drop in the market has revealed the flaws of the most fragile players. This is particularly the case with Celsius, a platform that offers to earn interest by depositing cryptocurrencies. Accused of mismanagement of funds, the company would be close to default. Back to the wall, Celsius made the decision to block withdrawals and transfers.

Users are not able to recover their cryptocurrencies. In a blog post published this Monday, June 20, 2022a week after the blockage, Celsius warns that withdrawals and transfers will remain will not be reactivated anytime soon.

“We want our community to know that our goal continues to be to stabilize our liquidity and operations. This process will take time”warns Celsius.

Following Celsius, all eyes turned to Three Arrows Capital (3AC), an investment fund specializing in cryptocurrencies. Following the liquidation of several positions, the Singaporean fund would soon be insolvent. Several platforms, including BitMEX, have confirmed the company’s liquidations. Kyle Davies, the co-founder of 3AC, recently spoke about the difficulties his company has encountered in ensuring that it is committed ” solve the problems and find an equitable solution”.

Let us also mention the case of BabelFinance, a Hong Kong-based cryptocurrency lender. Following ” major fluctuations » of the market, the firm admits to meeting “unusual pressures on liquidity”. Babel Finance has announced the suspension of withdrawals and transfers for an indefinite period.

These companies would have lost millions of dollars as a result of the collapse of the UST, the stablecoin of the Terra ecosystem, in May. Designed to replicate the value of the US dollar, the UST abruptly lost parity last month. The event had blown a wind of panic on the world of crypto-assets.

Other, stronger players in the ecosystem have also been forced to change course. Reputable exchange platforms, such as Coinbase, Crypto.com or Gemini, have announced a drastic reduction in their workforce. It should be noted, however, that some leading companies in the sector, such as FTX, Kraken and Binance, seem impervious to the vagaries of the market. These companies have indicated that they are continuing to recruit new employees. For example, Binance has always more than 2,000 vacancies in Europe, Asia, South America, Africa and the Middle East.

Bloomberg

[related_posts_by_tax taxonomies=”post_tag”]

The post The fall of Bitcoin continues, the whole crypto market is in the red appeared first on Gamingsym.