Over the past year, I have delved deep into the world of credit card rewards, maximizing the value of redemption, points accumulation, and cashback, as well as taking advantage of lucrative welcome bonuses. One of the apps I used to learn more about all this is CardPointers, a great app from independent developer Emmanuel Cruvizier.

I had the opportunity to talk with Cruvizier about CardPointers, iOS 16, what it means to be a full-time indie developer in 2022, and more. In addition, an exclusive discount and offer for readers.

Practice: CardPointers can help maximize credit card rewards

Competition in the credit card industry has really intensified over the past few years. Companies like American Express, Chase and Capital One have expanded their offerings with massive welcome bonuses, new redemption offers, lucrative spending and reward categories, and more.

From experience, this can seem overwhelming and confusing at first. It’s easy to make mistakes; especially when card companies tempt you to redeem them at a low redemption cost. CardPointers is committed to helping you navigate through all of these situations.

When you open CardPointers for the first time, you will be prompted to go through the process of adding credit cards you already have. During this process, you can add your approval date, customize bonus categories as needed, and view all available offers.

Inserting the date you were approved for the card is especially important if the card has a welcome bonus or an annual fee. CardPointers can help you track your progress towards your welcome bonus and remind you when your annual fee is due.

The latter is especially important if you want to contact your card company and see if there are any retention offers to help offset the annual fee. (Hint: this is usually the case, you just need to threaten to cancel/downgrade your card first.)

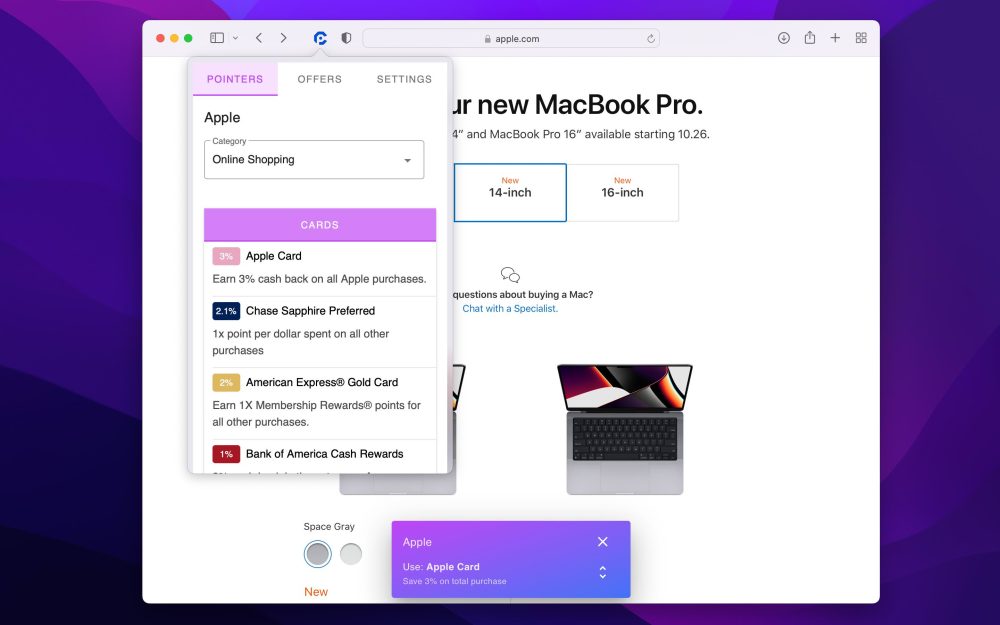

Once you’ve added your existing cards to CardPointers, you can click on the Pointers tab to see a list of the best cards to use for different spending categories. These offers are based solely on the cards you already have. For example, if you have an Amex Gold Card, you’ll probably see it as the best option for most restaurant and grocery shopping.

The Control Panel tab in the CardPointers app provides additional information about your cards. This includes a list of your cards, your total annual fees, your active offers, and more details on the best cards for different spending categories.

Finally, the “Dashboard” also includes an overview of the best card deals of the month in terms of welcome bonuses. If you’re looking to expand your credit card arsenal, this is a very handy tool to view welcome bonuses for some of the best cards.

Safari Extension

One of my favorite aspects of CardPointers is the Safari extension. The Safari extension is available on iPhone, iPad, and Mac. The main goal is to tell you which credit card is the best to use on a particular website in order to maximize the cashback or points you get for your purchase. For example, if you book a hotel, the CardPointers extension will show you which of your cards offers the best rewards for that purchase.

Another great benefit of the CardPointers extension for Safari is that it supports the ability to activate all of your available offers on the Chase and American Express websites.

When you visit Chase or American Express, you will see a CardPointers notification that will allow you to quickly enroll in your offers. Once you do this, the offers will also be synced to your CardPointers account and counted towards all offers and pointers.

CardPointers supports a number of different iOS, macOS, and iPadOS system features. This includes things like app clips, sign in with Apple, home screen widgets, quick notes, Siri integration, and more. There’s also a dedicated app for the Apple Watch, as well as apps for the iPad and Mac.

You can get started with CardPointers through this link and get an exclusive 20% discount for being a .

iOS 16

This week I had the opportunity to speak with CardPointers developer Emmanuel Cruvizier. I was particularly interested in what he had planned for iOS 16 and other new Apple software releases coming out this fall. His answer? Basically everything.

Cruvizier: On the first day of WWDC, I always think I’ll only have a few little things I can include in my app to keep it looking fresh, but by the time I’ve finished watching all of the relevant session videos, I’ve got a to-do list from 100+ items. This year is no different.

App Intentions: They make creating new shortcuts *so* quick and easy for developers. I already had 5 shortcuts in the app, but the ability to automatically enable one of them when the app is installed makes them much more accessible to users who don’t normally go to the Shortcuts app. I’ve made some big updates to the “Which card?” section. shortcut, and now the user can just say the name of the store, not just the type of purchase they are making, and the app will instantly tell them which card to use there to maximize their points, or use an Amex or Chase offer. what they have there. It even works entirely with Siri, so if the user has their own AirPods, they can use Hey Siri and know which card to use in a second without having to pull out their phone or check the watch app. Focus Filters: Apple has finally forced me to use focus modes with them, and now I can’t imagine working any other way. I followed Apple’s implementation example and used them at work to only show my business cards in the app, and I created a custom focus mode called “Travel” which I set to filter all cards with a foreign exchange fee in the app. so I’m not surprised by the additional 3% commission on purchases abroad. This is a feature that many users have been asking for, and integrating it with focus filters was a perfect fit. Lock Screen Widgets: I’ve had issues with the Watch app since version 1 and widgets when they were available, and now I have a new place where users can put the information that matters most to them. This would be a great place to add a reminder for the special category bonus and expiring offers, and I’ll also look at a few new ideas. Swift Charts: This is the most amazing API I have ever seen from Apple. With just a few lines of code, you can get really nice charts with great accessibility features, but it can do some really complex things with just a few more lines; it’s a huge addition to SwiftUI. There are a lot of chart apps in the app that I’ve wanted to make for a long time but didn’t want to make my own chart library. Problem solved!

Transition to indie

Early this year, Cruvizier made the decision to quit his full-time job at the startup and focus entirely on CardPointers. Given the broader context of recent changes to the App Store, I asked him how his first six months of full-time indie work went.

Cruvizier: I think this is the best decision I have ever made for myself! I’ve been working on CardPointers since 2019 and for almost all of that time I was also working at a startup which meant ~16 hour workdays, sacrificing sleep to have time to work, no evenings or weekends to unwind and I’ve definitely gone through a few unhealthy periods of burnout, especially at the end of the summer, when every year was preparing for the release of iOS.

Since I quit my job at a startup and was able to focus solely on CardPointers, literally everything in my life has improved: I sleep well every day, I have the opportunity to relax (somewhat) in the evenings and weekends (I’m still a bit of a workaholic) , and CardPointers is doing better than ever – my first 2 months were purely business focused. I tripled my income in 2 months by focusing on app and extension marketing and business development, not just app improvement.

Apple’s Small Business Program was great at helping me save 15% on App Store sales, but I’ve found many benefits to using an online checkout through Stripe and RevenueCat to save even more and stay within the small business revenue cap longer. . From the user’s point of view, nothing beats the ease of an in-app purchase other than an Apple Pay discount through an online checkout. The two together work fantastically well to reach all types of users.

Apple Card

Finally, given his deep and unrivaled knowledge of the credit card and rewards industry, I asked Emmanuel what he thought of the Apple Card. His advice? You’re probably better off with another card.

Cruvisier: A good bonus card has many more benefits, such as Chase Freedom, Sapphire Preferred, Citi Premier or Amex Gold. With these cards, you can earn transfer points, which you can transfer to airlines and hotels to get much more value from the points you earn – and their points multipliers for most categories are also much higher than the Apple Card.

The most you can get with an Apple Card is a 3% return on your purchase, while with the cards I mentioned you can get 5x more points in some categories like restaurants, gas stations, etc. and those points are worth even more as you can redeem them for things like business class seats in Europe.

If someone spends $10,000 on their Apple Card within a year, they will get back a maximum of $300, whereas the same $10,000 spent on a good rewards card can earn them 50,000 points and these points can be worth 4 a cent or more for good repayment. , which means the real cost would be $2,000. Literally 7 times the value of using a good reward card, and that’s what CardPointers helps users do – earn more from every purchase, just by paying with the right card.

Even if you just want to focus on cashback, other cards can bring the same cashback as the Apple Card for even more categories and merchants. I would love to see Apple Card further improve its revenue categories and more and more banks are doing deals directly with specific merchants as a form of advertising so I think we will continue to see more of this across all cards as advertising. new source of income for them.

Conclusion

CardPointers is available as a free download and an in-app subscription is available to unlock CardPointers Pro features.

Readers can save 20% on annual and lifetime CardPointers Pro plans. In fact, if you upgrade to a Lifetime plan through this link, you’ll also get a $100 savings card that effectively makes the upgrade free.

More developer interviews:

similar

The post CardPointers maximizes your credit card rewards with apps for iPhone, iPad and Mac. appeared first on Gamingsym.