In China, smartphone sales fell 14.2% in the second quarter of 2022. The last time the Chinese market showed such low results was almost a decade ago when the iPhone 5.

New figures from Counterpoint Research paint an alarming picture for the Chinese smartphone market. In China, smartphone sales have known a new significant low in the second quarter of 2022, down 14.2% year over year. The numbers hit their lowest level in a decade, returning to a level not seen since the fourth quarter of 2012. At that time, Apple had just introduced the iPhone 5 and the market was in a phase of continued growth at the time. global scale. The peak will be reached in December 2016 and the sector has since descended from its cloud.

For comparison, the second quarter 2022 chinese sales were 12.6% lower than those recorded in the first quarter of 2020, a period marked by the start of the Covid-19 crisis. They were also halved compared to those recorded in the fourth quarter of 2016. Admittedly, sales have always varied according to the quarters, but a slow decline continues.

Smartphone sales: what’s going on?

If the figures from Counterpoint Research relate only to the Chinese market, they reflect a general trend. In Europe, our colleagues from 01net recalled at the end of June that sales were at their lowest for nine years. Several factors may explain manufacturers’ difficulties in increasing sales.

The market first became mature due to a glaring lack of innovation. For a few years, no manufacturer has been able to offer a real breakthrough allowing a new cycle to be (re)launched. 5G, whose arrival was eagerly awaited, gave a boost to several brands like Apple, but the benefits brought by this technology will not be visible for a few years. As for the smartphone itself, the changes are more subtle and do not promote sales while ecological issues no longer push to renew your phone as often.

Other external causes also explain the decline in sales. The start of the Covid-19 pandemic completely disrupted the sector, followed by a shortage of componentsof the war in ukraine and of theinflation. The Chinese government’s “anti-Covid” strategy is also having consequences, pushing the country closer to recession. “Major Chinese cities, including the financial and manufacturing hub of Pan-Shanghai, have suffered full or partial lockdown”explains Ivan Lam, analyst of Counterpoint.

Who dominates the Chinese market?

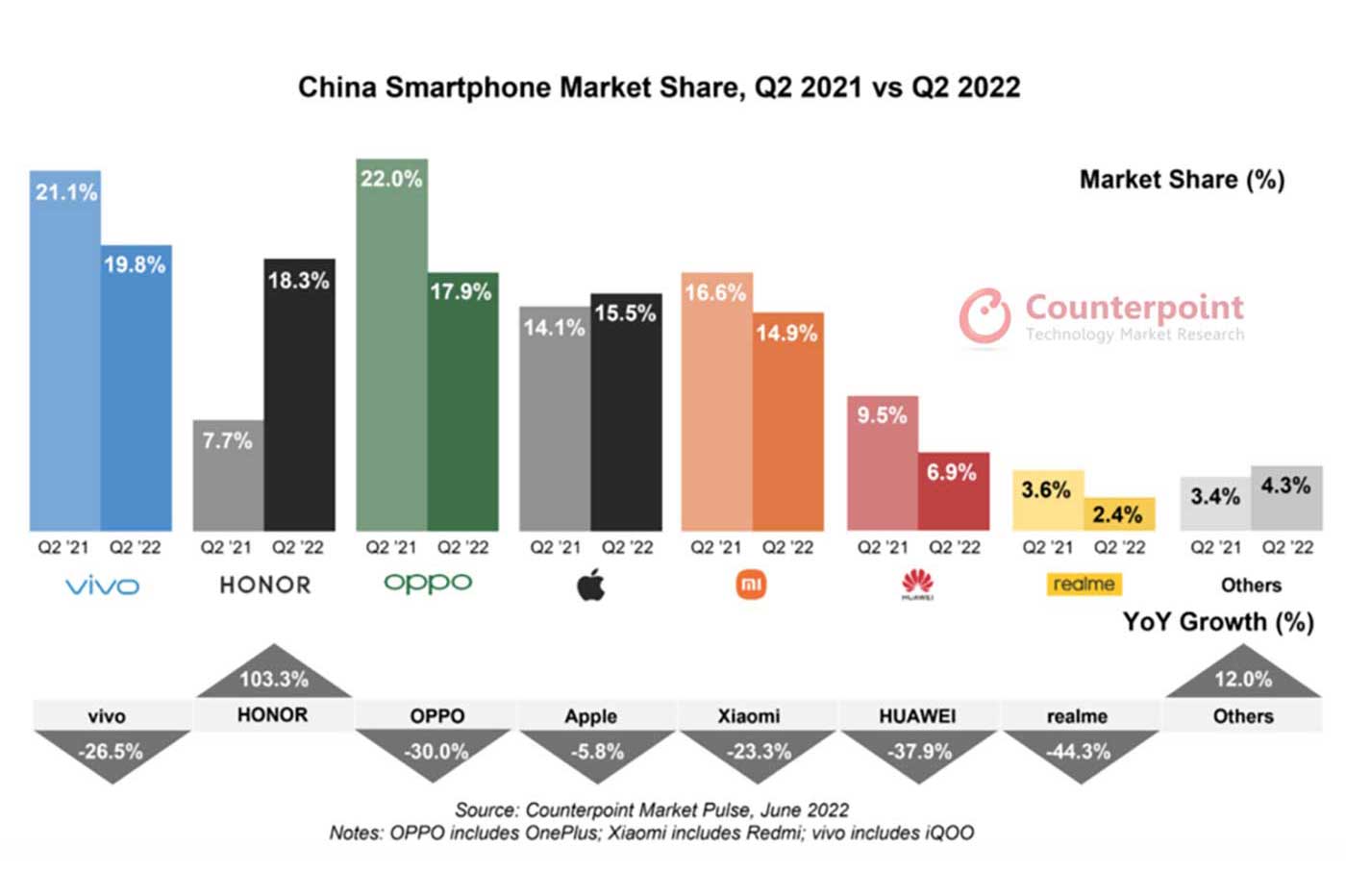

It is not because the sector is doing badly that the battle is not raging between the manufacturers. The main players in the market came to a halt in the second quarter of 2022. Vivo, Oppo, Xiaomi and Huawei recorded a double-digit decline compared to the second quarter of 2021. Apple did relatively well thanks to the iPhone, with a decline of 5.8%.

Conversely, Honor confirms its return to the forefront by doubling its sales figures to go from a market share of 7.7% to 18.3%. The former Huawei brand takes second place in the Chinese market, between Vivo and Oppo. “Honor continues its great comeback”says analyst Mengmeng Zhang. “It can be noted that Honor managed to take shares from all major Chinese brands, including Huawei, during the quarter. It’s time for Oppo and Vivo […] to take Honor seriously”. Competition is warned.

Honor Magic4 Pro at the best price Base price: €1,099

See more offers

[related_posts_by_tax taxonomies=”post_tag”]

The post The worrying fall in smartphone sales continues appeared first on Gamingsym.